- Products

- RegLab for ...

- Knowledge centre

Download the AML glossary >

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide - The company

Working at RegLab >

Join RegLab as the new Product Owner of our software tool and change the way the legal community approaches anti-money laundering.

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

Boost your AML risk management

RegLab simplifies AML compliance by streamlining and automating the entire process. We ensure a seamless client onboarding experience and check automatically for sanctions, watchlists, PEPs and adverse media.

An effective screening process

Manual screening is no longer required! We make sure that any new matters are automatically and thoroughly screened for PEPs, sanctions and/or adverse media. This ensures that no critical source is overlooked.

You want to save time and effort by having your client files automatically screened. RegLab helps you with this challenging task. Choose a fully AML-compliant screening process by using the RegLab application.

RegLab gives you the ability to manage and streamline the entire AML process from a single platform, eliminating the need for separate subscriptions to external parties. This not only simplifies the onboarding process but also enhances clarity and efficiency.

This useful feature is available thanks to our integration with Comply Advantage. They continuously gather and update data from a multitude of sources on high-risk individuals, entities, and activities. This ensures that our application remains up to date!

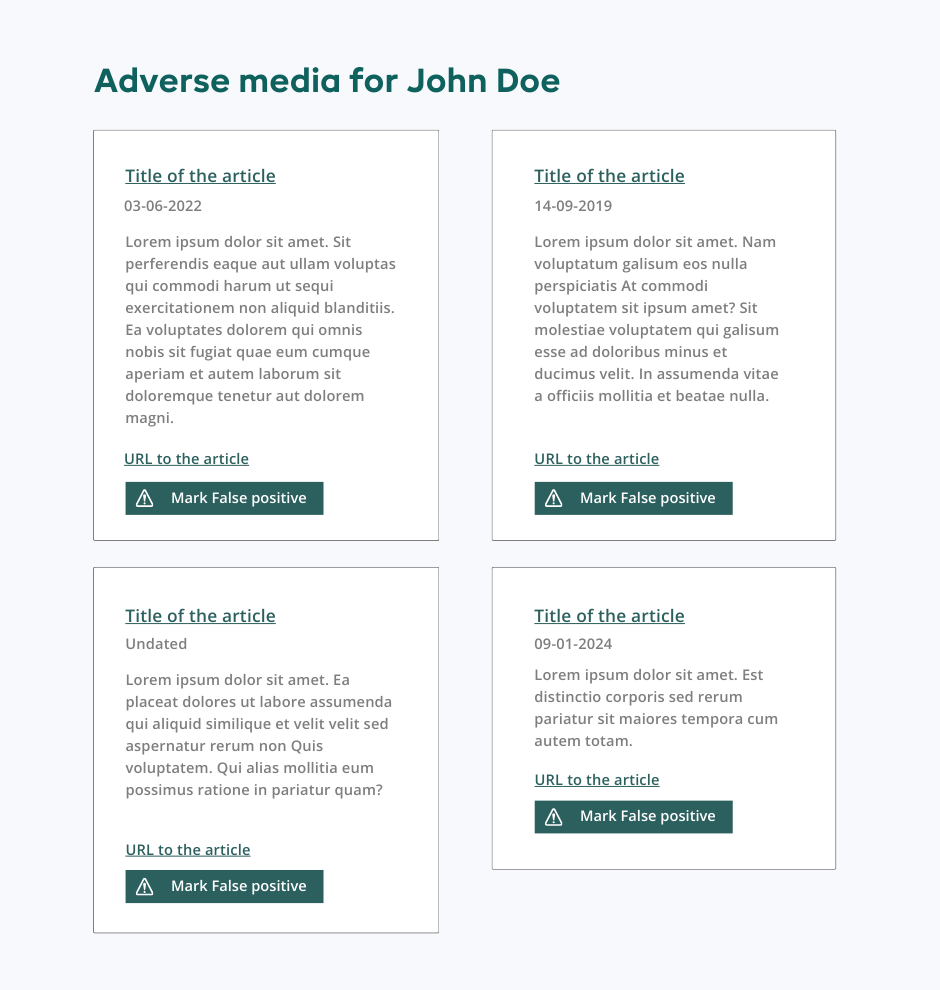

Adverse media check

When you add a person (such as a representative, contact, UBO or PEP) to a matter, a thorough check is initiated immediately to identify any adverse media coverage.

You will see an overview of relevant articles about the added person, including their sources, publication dates, and opening lines. Would you like to read the relevant article in full? Simply, click the link within the application to view it in its entirety.

If an article is a "false positive" and does not contain relevant or negative mentions, you can flag it as such. This helps you maintain a clear overview of adverse media.

Screen watchlists

An automatic check takes place to verify whether the client appears on any of the various sanction- or watchlists. Global lists as well as lists from different government agencies are checked.

Individuals and entities on these lists are typically viewed as high-risk due to their involvement in criminal activities, links with terrorist organisations, money laundering or other prohibited practices. Therefore, it is crucial to review these lists!

If the client is found on a list, you will be notified promptly, enabling you to take the necessary action.

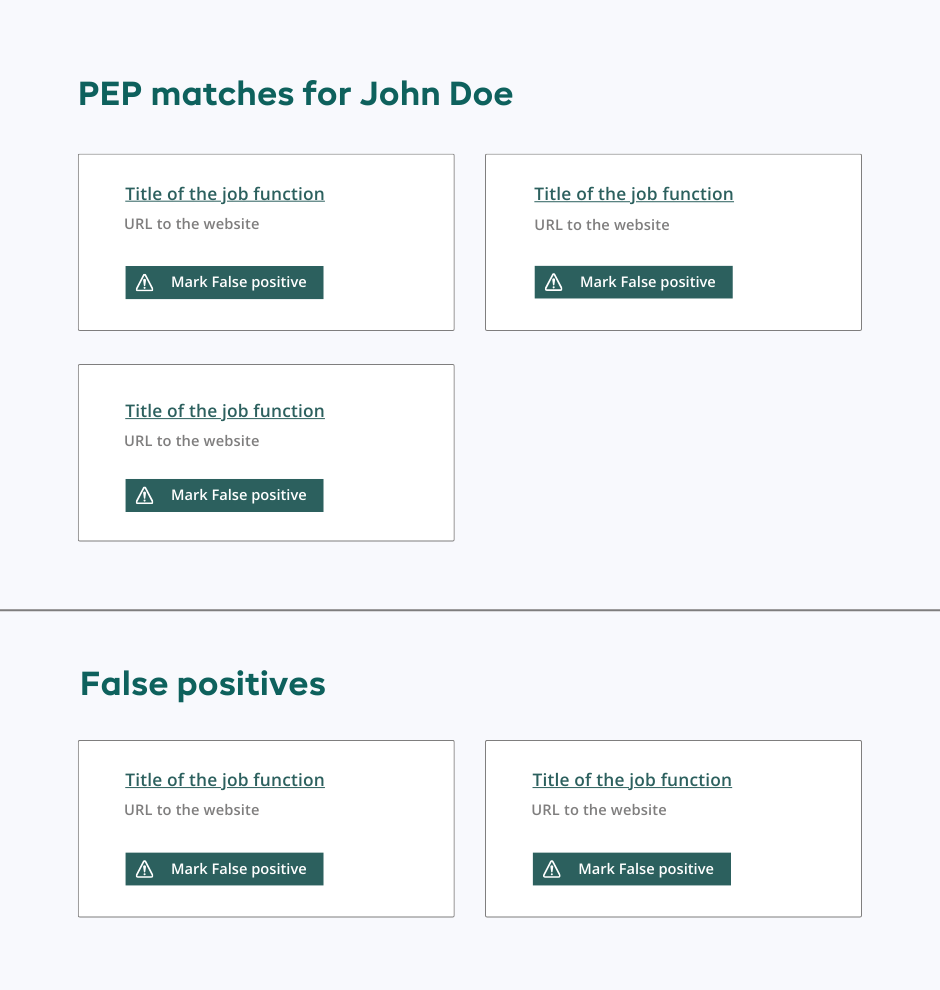

Conduct a PEP-check

PEP stands for "Politically Exposed Person". Due to their influential position, they tend to present a higher danger of engaging in illicit activities like money laundering. Knowing whether you are working with a PEP is crucial for this reason.

Thanks to our automated PEP check, be the first to know about significant changes in the client's risk status.

This check is performed automatically when someone is added to the matter. Does the individual emerge as a PEP? You will receive an overview of his or her various job functions. Again, you have the option of indicating whether a result is a 'false positive'.

Sparked your interest?

Want to take your compliance process to the next level while increasing efficiency? Get in touch for options and costs. See for yourself how the RegLab application will help you be 100% AML compliant.

Schedule an appointment at the date and time that suits you most

Our specialist shows you the application step by step via Microsoft Teams

Easily comply with AML without disrupting your client relationship

These firms rely on RegLab

Testimonial —

SET Ventures

"We wholeheartedly recommend their services to fellow businesses seeking a smoother, stress-free journey towards regulatory compliance."

Testimonial —

Banning Lawyers

"RegLab has enabled us to ensure that many files that were non-compliant are now compliant."