- Products

- RegLab for ...

- Knowledge centre

Download the AML glossary >

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide - The company

Working at RegLab >

Join RegLab as the new Product Owner of our software tool and change the way the legal community approaches anti-money laundering.

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

The RegLab application

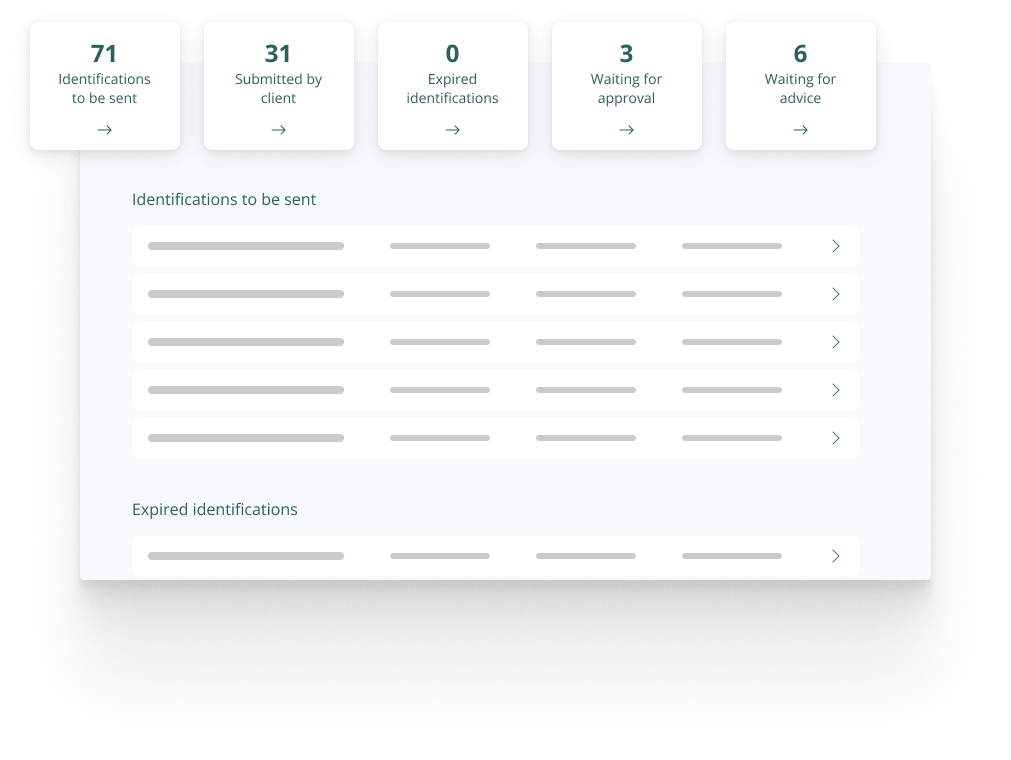

With RegLab's software and additional compliance services, every firm, either small or large, meets the AML requirements. The application automates the entire AML work process. That includes the client onboarding process. The result? A streamlined working method for every professional who takes working compliant seriously. It allows you to bring in clients with more ease and with more pleasure. And, not unimportantly, you avoid high fines.

Easy compliance with laws and regulations

Money laundering prevention: it is easier said than done. Often, employees often find it difficult to implement the open standards from the legislation. Our software helps you deal with this in a structured and responsible way. The RegLab application provides you with a stable, digital basis that guides you and your client through the AML process step by step. RegLab ensures that working fully AML-proof does not feel like slippery ice, but provides a stable foundation on which you can move forward “smoothly”.

Acquiring clients has never been so easy and customer-friendly. Sanction, UBO and PEP checks, determining risk profiles and sending engagement letters: you will find everything in one workflow. Forget about manual forms, welcome to working efficiently.

Client onboarding features

ID check

Screening

Have the engagement letter and privacy statement been approved by client? Does the matter comply with AML checks and is the risk profile substantiated? Feel proud to answer ‘yes’ to all these questions. RegLab makes it easy for you to do so.

Monitoring Features

AML module

Non-AML module

Reporting Features

An overview of AML and non-AML matters and risk profiles at the touch of a button? Convenient for both management and the regulator. Working compliant can be that easy.

Reporting features

Monitoring risk profiles

AML compliance services

Implementing an AML policy is not a straightforward task that you “just implement”. How do you ensure that the AML process is working well and what is expected of you during an audit? With RegLab's AML support, you are assured of a solid approach and execution. You can think of this in terms of policy support, but also in executive aspects such as reviews, audits, training and full outsourcing. This professional compliance support is also available for firms without AML software.

Frequently asked questions about the RegLab application

Is the AML content kept up-to-date?

Is the application only suitable for large firms?

Is the application only suitable for AML or also for non-AML matters?

Does the application also check for sanctions?

Does the application generate an overview for the supervisor?

How does the identification process work?

Creating a matter and sending an identification request can be done within 1 minute. The client then immediately fills in the required information. The application keeps track of this information and stores everything centrally. If the client does not provide information, the client will be reminded at times set by you.