- Products

- RegLab for ...

- Knowledge centre

Download the AML glossary >

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide - The company

Working at RegLab >

Join RegLab as the new Product Owner of our software tool and change the way the legal community approaches anti-money laundering.

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

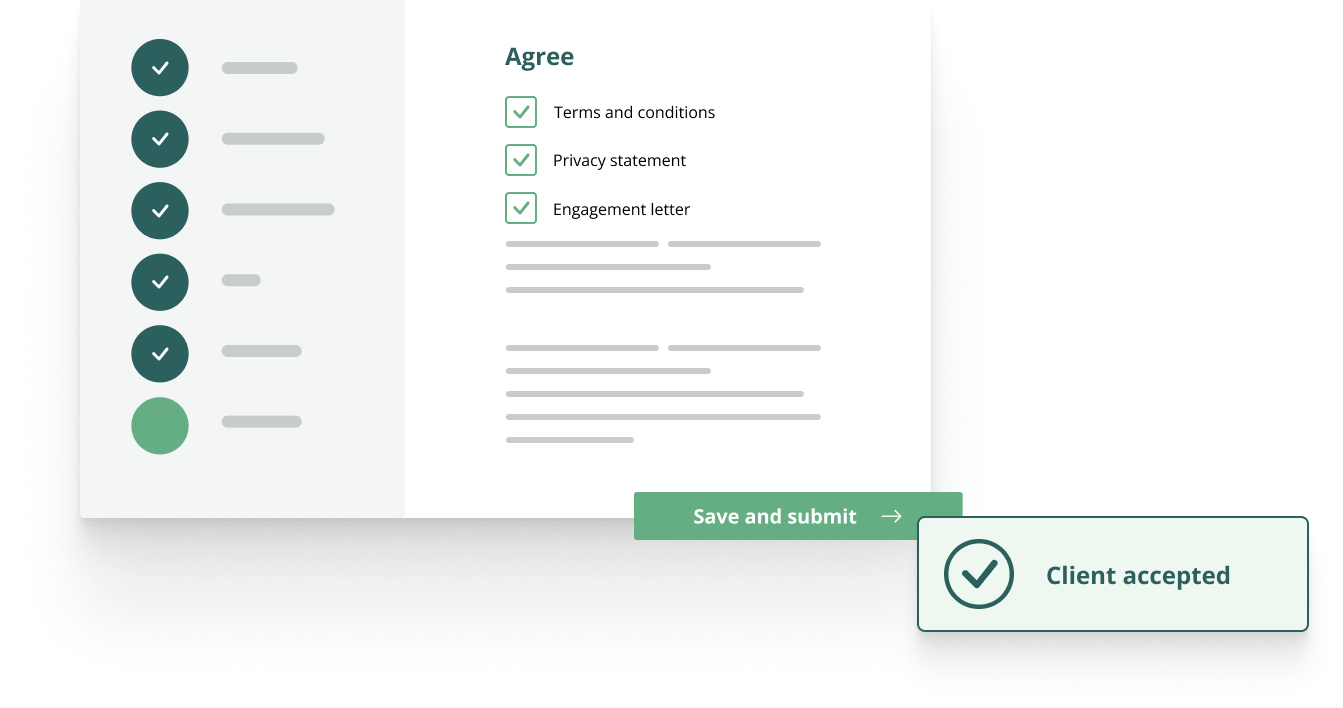

Approve engagement letter

A new client also means administrative work. Sending each client an engagement letter, general terms and conditions, and a privacy statement takes time. And it's not just a matter of sending them; you also need to make sure that the client agrees to them. Are your terms and conditions or rates changing? Then you need to ask for permission again.

The engagement letter

An engagement letter is an important part of your work. It sets out who your client is, what you will do, at what rate, and under what conditions. You should therefore send the document as complete as possible and ensure that you receive approval.

However, this proves difficult in practice. Many firms systematically forget to send documents, receive them back once approved, and store them centrally. This is a shame, because good administration is essential.

The purpose of the engagement letter is simple: you set out agreements on paper, avoid hassle afterwards, and provide insight into the costs. A written confirmation also helps you to think carefully about your approach. This improves the quality of your services and strengthens your relationship with your client.

That is why RegLab takes care of this process for you, entirely digitally. From sending to signing the engagement letter, and from reminders to central storage.

What should be included in the engagement letter?

An engagement letter should contain the following elements:

- A description of the matter, indicating whether it falls under AML;

- Name and address details of the client, counterparty, and lawyer/authorised party;

- Whether the client qualifies for financed legal aid, including an explanation;

- Information about any legal assistance available;

- Rate agreements;

- Information on professional liability;

- Agreements regarding confidentiality, ICT, and AML registration;

- How to deal with disputes.

Fast automated approval with RegLab

The process of engagement letters often takes an unnecessary amount of time. First, the document must be drawn up, then you have to ensure that it is signed and returned and stored in the right place. And then there is the matter of keeping track of changes, for example in the event of adjusted rates or conditions.

With RegLab, these challenges are a thing of the past. The AML application:

- sends the engagement letter automatically;

- keeps track of the status;

- sends reminders when responses are missing;

- stores everything centrally;

- generates status reports;

- processes new terms and conditions automatically;

- and generates an overview for the regulator with a single click.

KYC: the meaning of it

What is the meaning of KYC, what does a KYC procedure entail and what role does Customer Due Diligence play. Read the answers in this article