- Products

- RegLab for ...

- Knowledge centre

Download the AML glossary >

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide

Discover the essential AML compliance terminology and gain instant access to a comprehensive guide - The company

Working at RegLab >

Join RegLab as the new Product Owner of our software tool and change the way the legal community approaches anti-money laundering.

There may not be any vacancies that perfectly match your profile, but that does not mean there is no room for someone who can improve RegLab.

- Book a demo

RegLab for investment fund managers

Fulfill all AML obligations and save valuable time

As an investment firm, you are required to comply continuously with the AMLD and the Sanctions Act. All investor data must be kept up to date and closely monitored, on top of your regular day-to-day operations. These compliance processes demand time and resources from both you and your investors. Ideally, your focus would be on your investors and your portfolio, but ever-growing obligations can make this a real challenge.

With RegLab’s software, you can automate the entire compliance process, from onboarding to risk detection. This helps you avoid errors, save valuable time, and stay up to date with the latest regulations—all while keeping your attention on your core responsibilities. Regulators are satisfied, you are happy, and your investors benefit from a smooth, efficient onboarding process.

Need extra support? Our compliance specialists are ready to help. Whether it’s drafting risk profiles, assisting with audits, or reviewing investors, you’re not alone. And if you need to get started quickly, e.g., due to an upcoming inspection, you’ll be up and running within a week.

Learn more on this page about how our software helps your firm meet AML obligations with ease or book a demo.

AML module

This module is more than a simple 'check the box'. It is a well-thought-out workflow, making sure you are 100% compliant.

Comprehensive screening

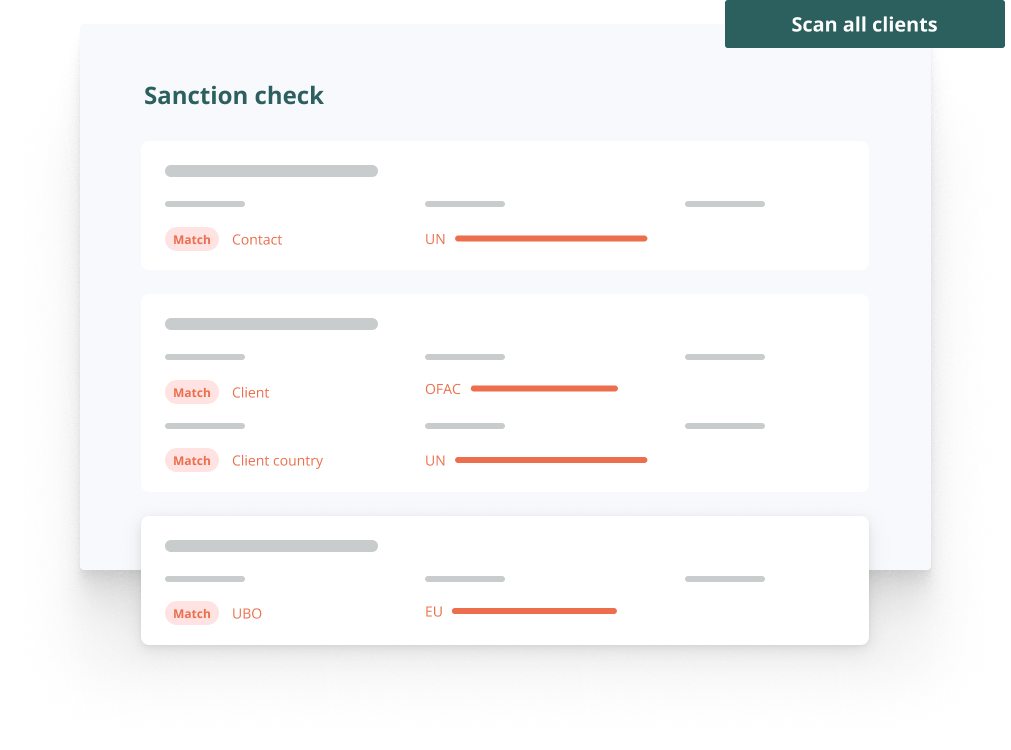

RegLab checks and informs you about all PEPs, adverse media, watchlists and sanction and high-risk country lists.

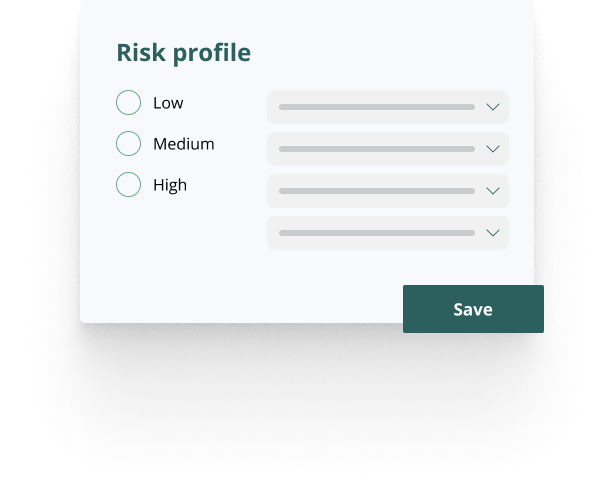

Capturing & Investigating Risk Profiles

Risk profiles are automatically identified and continuously monitored. Any escalations, actions and investigations are recorded.

AML compliance service

RegLab supports you with everything related to your AML policy. Our compliance specialists are at your service for training, risk profiles, policy plans, assistance with audits and checking and completing files.

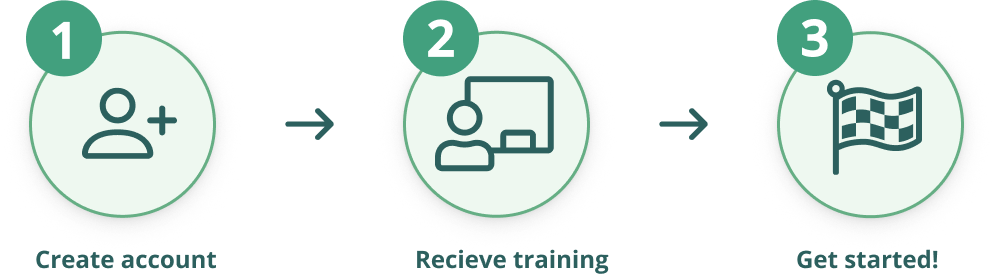

Getting started within a week

Do you want to get started with RegLab in the short term? For instance, because the regulator will be conducting an audit soon? You will be up and running within a week.

RegLab mini demo

See what the RegLab application can do for you in just two minutes.

Want to see more? Request a demo.

These companies preceded you:

Testimonials —

OPEN Development

"The AML process takes less time and has become more streamlined."

— Read more

Testimonials —

SET Ventures

"RegLab has revolutionized our KYC and AML processes, making them effortless and efficient for all parties involved."